Author: Pranav Deshpande

Read Time: 5-7 mins

Feb 4, 2025

Buy and Sell Loans on ONDC: Part-II

Buy and Sell Loans on ONDC: Part-II

Buy and Sell Loans on ONDC: Part-II

Author: Pranav Deshpande

Read Time: 5-7 mins

Feb 4, 2025

The ONDC initiative was created with the objective to democratize e-commerce by creating an open network that enhances visibility and accessibility for businesses, particularly in Tier 2 and Tier 3 cities, where a large portion of India's population resides.

Digital lending is currently changing how people access loans in India, especially for small business owners, gig workers, and rural residents who struggled with traditional banks due to a lack of collateral or credit history.

About MSME Loan Requirements

The ONDC initiative was created with the objective to democratize e-commerce by creating an open network that enhances visibility and accessibility for businesses, particularly in Tier 2 and Tier 3 cities, where a large portion of India's population resides.

Digital lending is currently changing how people access loans in India, especially for small business owners, gig workers, and rural residents who struggled with traditional banks due to a lack of collateral or credit history.

About MSME Loan Requirements

As of 2024, less than 15% of the loan requirements of Micro, Small, and Medium Enterprises (MSMEs) are currently being met by formal lenders like banks and financial institutions. This means there’s a huge unmet demand for loans in this sector, amounting to INR 25 trillion.

The MSME sector is very important for India’s economy, with 63.4 million businesses contributing 30% to the country’s GDP. Every year, the demand for loans in this sector is growing at a rate of 11.5%. A major reason for this growth is that smaller cities are seeing more economic activity. As incomes rise and people in these cities become more financially stable, MSMEs in these areas are expanding and need more credit.

Looking ahead, it’s expected that by 2030, a large number of families in these cities will move into higher income groups. This means there will be even more opportunities for businesses to grow, further increasing the need for loans to support their operations.

As of 2024, less than 15% of the loan requirements of Micro, Small, and Medium Enterprises (MSMEs) are currently being met by formal lenders like banks and financial institutions. This means there’s a huge unmet demand for loans in this sector, amounting to INR 25 trillion.

The MSME sector is very important for India’s economy, with 63.4 million businesses contributing 30% to the country’s GDP. Every year, the demand for loans in this sector is growing at a rate of 11.5%. A major reason for this growth is that smaller cities are seeing more economic activity. As incomes rise and people in these cities become more financially stable, MSMEs in these areas are expanding and need more credit.

Looking ahead, it’s expected that by 2030, a large number of families in these cities will move into higher income groups. This means there will be even more opportunities for businesses to grow, further increasing the need for loans to support their operations.

What ONDC has achieved

ONDC has opened up endless opportunities in financial services, allowing businesses to offer MSME loans, personal loans, insurance, and mutual funds. This helps grow the economy, promotes financial inclusion, and boosts the digital marketplace. With features like escrow services and fraud protection, ONDC ensures safe transactions, building trust between buyers and sellers. It also gives underserved groups easier access to banking, lending, and insurance services, helping businesses and individuals thrive.

ONDC is already helping local businesses go digital by providing easy access to financing for inventory, logistics, and growth. Banks and NBFCs are working with ONDC to offer short-term loans and use transaction data to make lending decisions, helping SMEs get affordable loans.

What ONDC has achieved

ONDC has opened up endless opportunities in financial services, allowing businesses to offer MSME loans, personal loans, insurance, and mutual funds. This helps grow the economy, promotes financial inclusion, and boosts the digital marketplace. With features like escrow services and fraud protection, ONDC ensures safe transactions, building trust between buyers and sellers. It also gives underserved groups easier access to banking, lending, and insurance services, helping businesses and individuals thrive.

ONDC is already helping local businesses go digital by providing easy access to financing for inventory, logistics, and growth. Banks and NBFCs are working with ONDC to offer short-term loans and use transaction data to make lending decisions, helping SMEs get affordable loans.

ONDC launched a quick, paperless loan service in August 2024, and it now offers unsecured loans for salaried and self-employed individuals through apps like Easypay and Paisabazaar. By September 2024, ONDC plans to add GST invoice financing for SMEs.

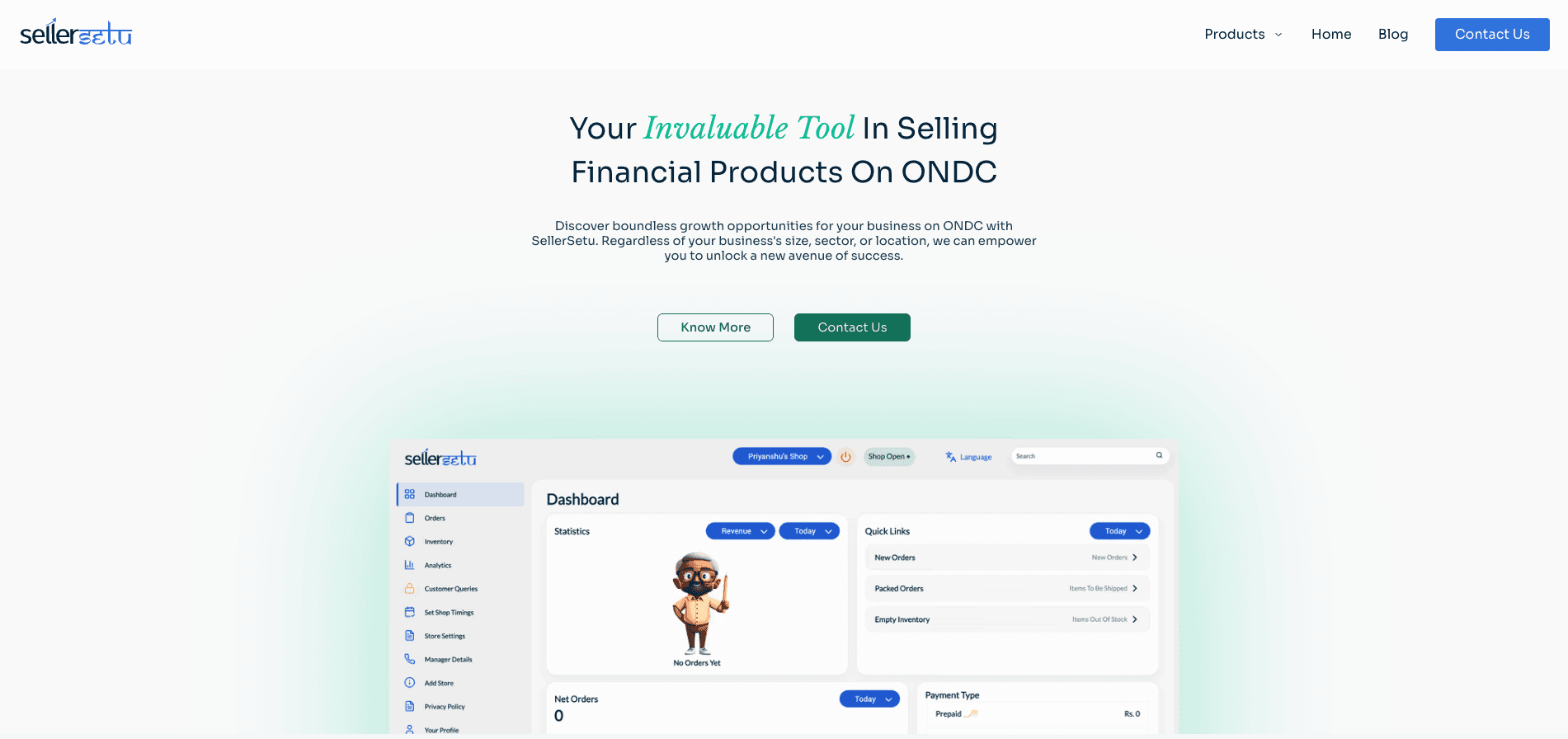

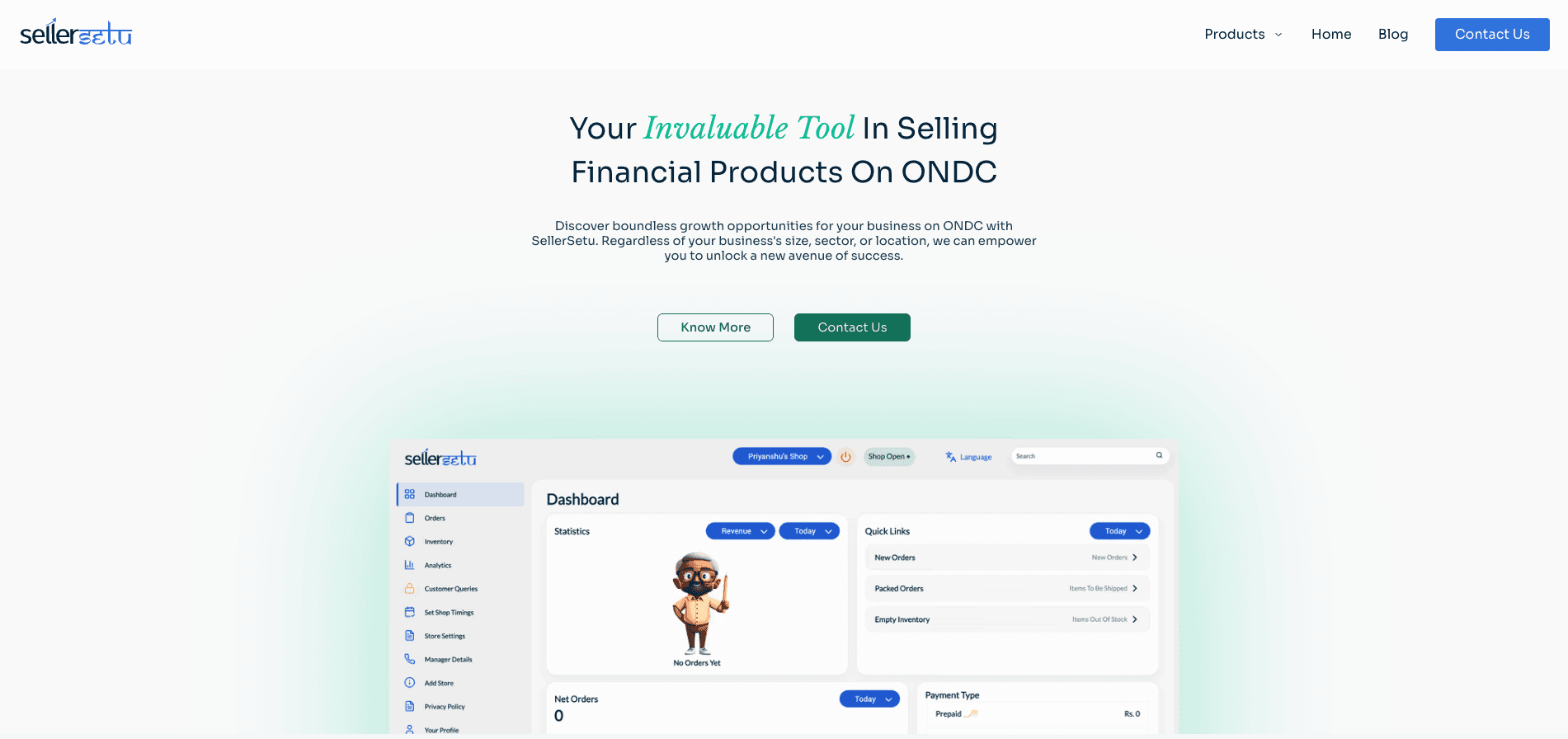

About FinSetu

If you join ONDC on your own, it can take up to 9 months of development, testing, and certification, plus a large team to stay on top of frequent updates and regulations.

But with FinSetu, we handle all the heavy lifting—maintenance, support, and updates—so you can focus on growing your business. We guarantee your business will be up and running in just 8-9 weeks, with data security and hassle-free compliance along the way.

ONDC launched a quick, paperless loan service in August 2024, and it now offers unsecured loans for salaried and self-employed individuals through apps like Easypay and Paisabazaar. By September 2024, ONDC plans to add GST invoice financing for SMEs.

About FinSetu

If you join ONDC on your own, it can take up to 9 months of development, testing, and certification, plus a large team to stay on top of frequent updates and regulations.

But with FinSetu, we handle all the heavy lifting—maintenance, support, and updates—so you can focus on growing your business. We guarantee your business will be up and running in just 8-9 weeks, with data security and hassle-free compliance along the way.

FinSetu makes connecting with ONDC easy, offering services like personal loans, insurance, and mutual funds. We take care of everything behind the scenes—updates, support, and maintenance—so you can focus on your customers. With lifelong upgrades and seamless integration, we make the process simple and hassle-free.

Ready to kickstart your successful journey on ONDC? Join the growing community of successful sellers who rely on SellerSetu for their online selling needs. Begin selling on the top online marketplace on ONDC today.

FinSetu makes connecting with ONDC easy, offering services like personal loans, insurance, and mutual funds. We take care of everything behind the scenes—updates, support, and maintenance—so you can focus on your customers. With lifelong upgrades and seamless integration, we make the process simple and hassle-free.

Ready to kickstart your successful journey on ONDC? Join the growing community of successful sellers who rely on SellerSetu for their online selling needs. Begin selling on the top online marketplace on ONDC today.

More on ONDC…

More on ONDC…

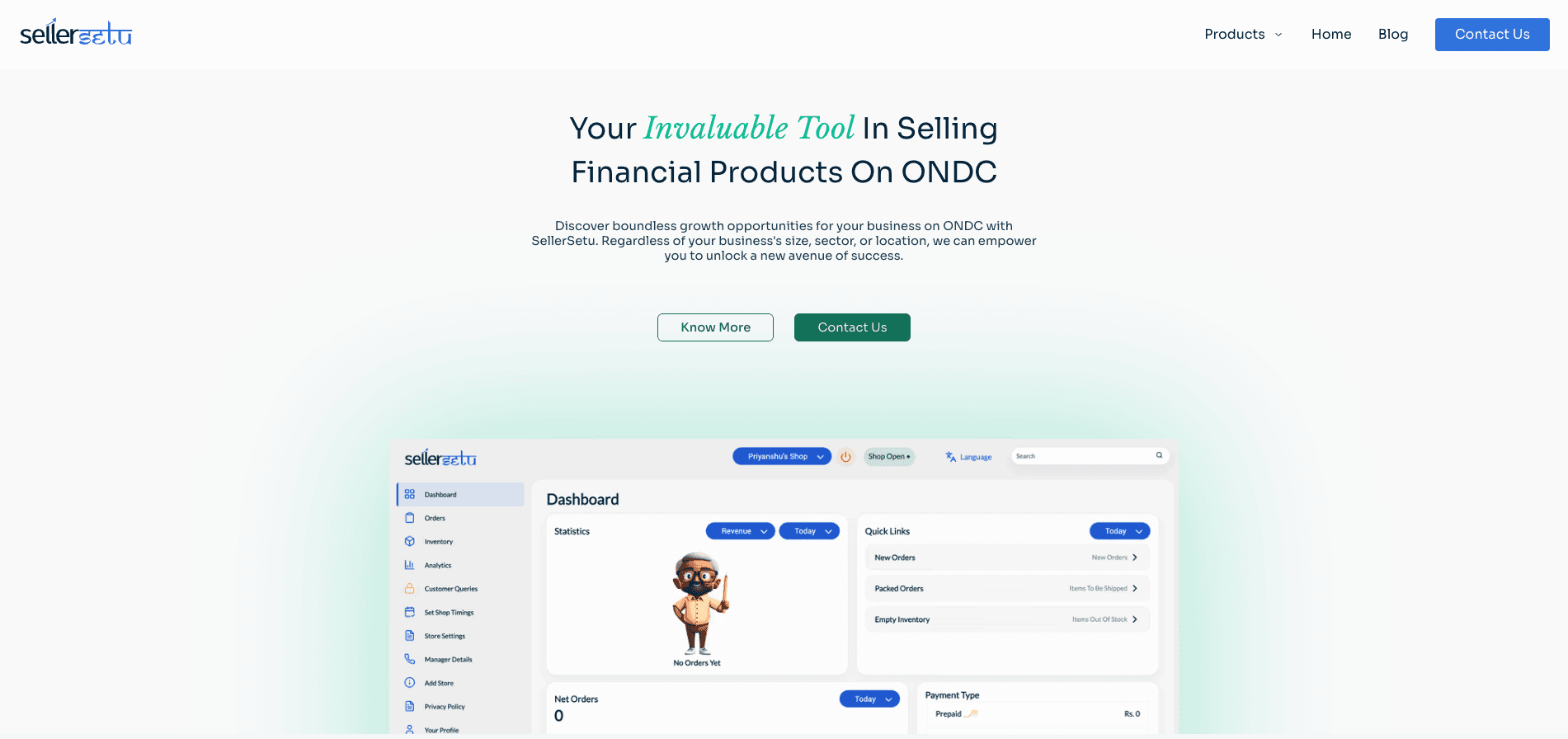

Are You Ready To Start A Successful Journey On ONDC ?

Join the growing community of successful sellers who trust SellerSetu for their online selling needs. Start selling on the best online marketplace on ONDC. Fill out this form, and our team will reach out to you within the next 24 hours.

Are You Ready To Start A Successful Journey On ONDC ?

Join the growing community of successful sellers who trust SellerSetu for their online selling needs. Start selling on the best online marketplace on ONDC. Fill out this form, and our team will reach out to you within the next 24 hours.

Are You Ready To Start A Successful Journey On ONDC ?

Join the growing community of successful sellers who trust SellerSetu for their online selling needs. Start selling on the best online marketplace on ONDC. Fill out this form, and our team will reach out to you within the next 24 hours.