Author: Pranav Deshpande

Read Time: 5-7 mins

Jan 16, 2025

Buy and Sell Loans on ONDC: Part-I

Buy and Sell Loans on ONDC: Part-I

Buy and Sell Loans on ONDC: Part-I

Author: Pranav Deshpande

Read Time: 5-7 mins

Jan 16, 2025

Digital lending in India has seen explosive growth in recent years, driven by increased internet penetration and smartphone usage. As of 2023, the digital lending market in India is estimated to be worth over $250 billion and is expected to grow at a CAGR of around 25% over the next few years.

Platforms like BharatPe, Cred, and Lendingkart have simplified access to loans for individuals and small businesses, with over 100 million Indian users engaging with digital lenders. The rise of FinTech companies, along with government-backed initiatives like the Pradhan Mantri Jan Dhan Yojana, has played a key role in expanding financial inclusion. Despite regulatory challenges and ambiguity, digital lending continues to disrupt traditional banking models in India.

How Lending Works on ONDC

ONDC is building a platform to make borrowing easier and more affordable by connecting buyers, sellers, fintech companies, borrowers and lenders. In its first phase, it will offer personal loans and GST-based loans to small businesses.

Borrowers can use Buyer Apps such as Tata Digital, Pay Nearby, Paisabazaar, Easy Pay, and others on ONDC to find and apply for loans by sharing their details, which are then forwarded to licensed lenders.

Lenders review the information, present loan offers, and finalize loans with borrowers in just 5 to 10 minutes. ONDC serves as a platform facilitating connections between borrowers and lenders but does not directly engage in the loan process.

Digital lending in India has seen explosive growth in recent years, driven by increased internet penetration and smartphone usage. As of 2023, the digital lending market in India is estimated to be worth over $250 billion and is expected to grow at a CAGR of around 25% over the next few years.

Platforms like BharatPe, Cred, and Lendingkart have simplified access to loans for individuals and small businesses, with over 100 million Indian users engaging with digital lenders. The rise of FinTech companies, along with government-backed initiatives like the Pradhan Mantri Jan Dhan Yojana, has played a key role in expanding financial inclusion. Despite regulatory challenges and ambiguity, digital lending continues to disrupt traditional banking models in India.

How Lending Works on ONDC

ONDC is building a platform to make borrowing easier and more affordable by connecting buyers, sellers, fintech companies, borrowers and lenders. In its first phase, it will offer personal loans and GST-based loans to small businesses.

Borrowers can use Buyer Apps such as Tata Digital, Pay Nearby, Paisabazaar, Easy Pay, and others on ONDC to find and apply for loans by sharing their details, which are then forwarded to licensed lenders.

Lenders review the information, present loan offers, and finalize loans with borrowers in just 5 to 10 minutes. ONDC serves as a platform facilitating connections between borrowers and lenders but does not directly engage in the loan process.

(Credit: Economic Times)

These are the 5 major steps of applying for a loan on ONDC

Step 1: Share Details and Pick a Loan Offer

The borrower shares basic information, like their PAN, mobile number, or GST details (for businesses), on a buyer app which is then sent to the lenders.

The app shows loan offers from different lenders, and the borrower picks the one they like best. This allows the borrower to easily compare different options side by side based on their preferences, such as the lowest interest rate, flexible repayment terms, or quick processing times, which is exactly what ONDC offers.

Lenders use their Base Rate (BR) and Loan Management System (LMS) to automatically generate and send loan quotes to potential borrowers. This process is fully automated.

For example: if a user applies for a ₹5 lakh loan, their details are shared with multiple lenders. Each lender reviews the request and sends their best offer. One lender might offer ₹3 lakh at 18% interest for 2 years, while another might offer ₹4 lakh at 21% interest.

Step 2: Complete KYC

After selecting a loan, the borrower verifies their identity through Aadhaar eKYC, Digilocker, or a video call.

Step 3: Add Bank Details

The borrower provides their bank account details for receiving the loan and setting up easy repayment options like auto-debit.

Step 4: Review and Approve Terms

The borrower reads the loan terms and conditions, agrees to them, and signs the agreement digitally using an OTP or Aadhaar eSign.

Step 5: Get the Loan Amount

The lender approves the loan and transfers the money directly to the borrower’s bank account. The borrower can manage the loan using the buyer app.

(Credit: Economic Times)

These are the 5 major steps of applying for a loan on ONDC

Step 1: Share Details and Pick a Loan Offer

The borrower shares basic information, like their PAN, mobile number, or GST details (for businesses), on a buyer app which is then sent to the lenders.

The app shows loan offers from different lenders, and the borrower picks the one they like best. This allows the borrower to easily compare different options side by side based on their preferences, such as the lowest interest rate, flexible repayment terms, or quick processing times, which is exactly what ONDC offers.

Lenders use their Base Rate (BR) and Loan Management System (LMS) to automatically generate and send loan quotes to potential borrowers. This process is fully automated.

For example: if a user applies for a ₹5 lakh loan, their details are shared with multiple lenders. Each lender reviews the request and sends their best offer. One lender might offer ₹3 lakh at 18% interest for 2 years, while another might offer ₹4 lakh at 21% interest.

Step 2: Complete KYC

After selecting a loan, the borrower verifies their identity through Aadhaar eKYC, Digilocker, or a video call.

Step 3: Add Bank Details

The borrower provides their bank account details for receiving the loan and setting up easy repayment options like auto-debit.

Step 4: Review and Approve Terms

The borrower reads the loan terms and conditions, agrees to them, and signs the agreement digitally using an OTP or Aadhaar eSign.

Step 5: Get the Loan Amount

The lender approves the loan and transfers the money directly to the borrower’s bank account. The borrower can manage the loan using the buyer app.

Here’s a brief video to guide you through the process step-by-step: Tutorial for Loans on ONDC

Technical Aspects of Applying for Loans on a Buyer App

First, the user searches for loans on Buyer Apps such as Tata Digital, which shows basic loan details. After selecting a bank, the buyer app triggers the bank's API to request consent through the Account Aggregator (AA) platform.

The bank retrieves the user’s bank statement and credit score to generate a loan offer, which is displayed to the user. If the user requests a lower amount, the buyer app triggers the bank’s API to regenerate the offer.

The user then completes KYC, provides bank details, and signs the loan agreement. Finally, the loan amount is disbursed to the user’s account.

Loans through ONDC are considered digital lending because the whole process, from finding borrowers to approving and giving loans, happens digitally.

Here’s a brief video to guide you through the process step-by-step: Tutorial for Loans on ONDC

Technical Aspects of Applying for Loans on a Buyer App

First, the user searches for loans on Buyer Apps such as Tata Digital, which shows basic loan details. After selecting a bank, the buyer app triggers the bank's API to request consent through the Account Aggregator (AA) platform.

The bank retrieves the user’s bank statement and credit score to generate a loan offer, which is displayed to the user. If the user requests a lower amount, the buyer app triggers the bank’s API to regenerate the offer.

The user then completes KYC, provides bank details, and signs the loan agreement. Finally, the loan amount is disbursed to the user’s account.

Loans through ONDC are considered digital lending because the whole process, from finding borrowers to approving and giving loans, happens digitally.

Why Choose ONDC for Financial Services?

Buyer Apps act as middlemen, helping borrowers apply for loans and providing the tools to complete the process. These apps must follow RBI rules for digital lending, such as being transparent about loan details (like interest rates and fees) and protecting borrower information. Lenders also have to follow these rules and ensure borrower data is secure. This creates a safe and transparent lending environment as these regulations ensure safety of private information.

ONDC helps lenders connect with more borrowers and offer different loan options by bringing together a variety of borrowers from different geographical locations.

Another key benefit of ONDC lending is its use of helpful data to decide on loans. The platform collects details like transaction history, sales, and financial habits, so lenders can understand a borrower’s financial situation better. For example, an MSME can be assessed for a loan based on live data like sales and cash flow. This approach helps lenders avoid risky loans and create more accurate credit scores by using extra data like online sales and customer feedback, not just traditional credit reports.

To understand the credit business requirements, refer to this document: Credit Business Requirements

Other Services like ONDC

ONDC, OCEN (Open Credit Enablement Network), and ULI (Unified Logistics Interface Platform) are all frameworks that aim to revolutionize lending in India by using digital platforms, but they are different in how they facilitate the lending process.

Why Choose ONDC for Financial Services?

Buyer Apps act as middlemen, helping borrowers apply for loans and providing the tools to complete the process. These apps must follow RBI rules for digital lending, such as being transparent about loan details (like interest rates and fees) and protecting borrower information. Lenders also have to follow these rules and ensure borrower data is secure. This creates a safe and transparent lending environment as these regulations ensure safety of private information.

ONDC helps lenders connect with more borrowers and offer different loan options by bringing together a variety of borrowers from different geographical locations.

Another key benefit of ONDC lending is its use of helpful data to decide on loans. The platform collects details like transaction history, sales, and financial habits, so lenders can understand a borrower’s financial situation better. For example, an MSME can be assessed for a loan based on live data like sales and cash flow. This approach helps lenders avoid risky loans and create more accurate credit scores by using extra data like online sales and customer feedback, not just traditional credit reports.

To understand the credit business requirements, refer to this document: Credit Business Requirements

Other Services like ONDC

ONDC, OCEN (Open Credit Enablement Network), and ULI (Unified Logistics Interface Platform) are all frameworks that aim to revolutionize lending in India by using digital platforms, but they are different in how they facilitate the lending process.

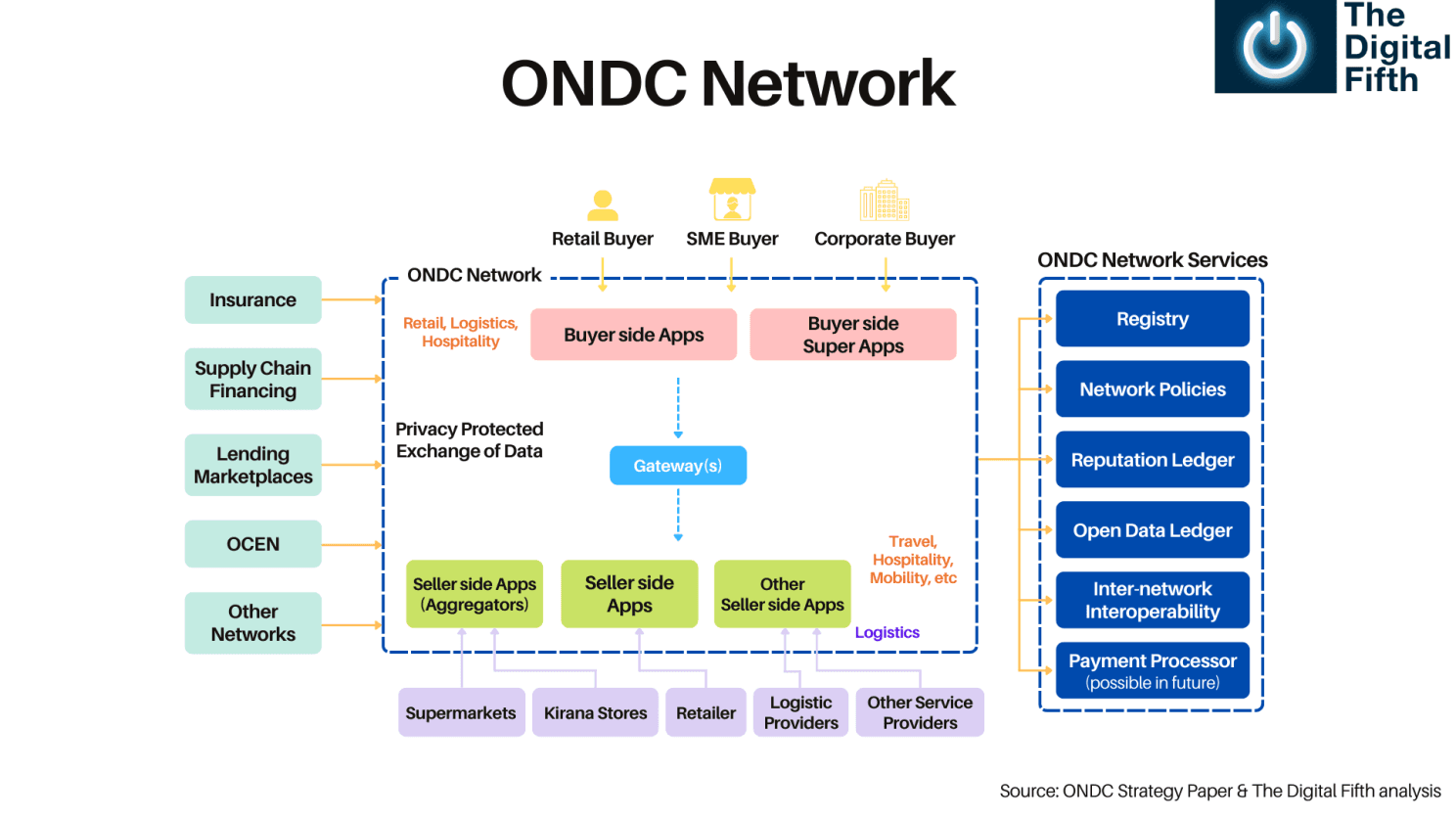

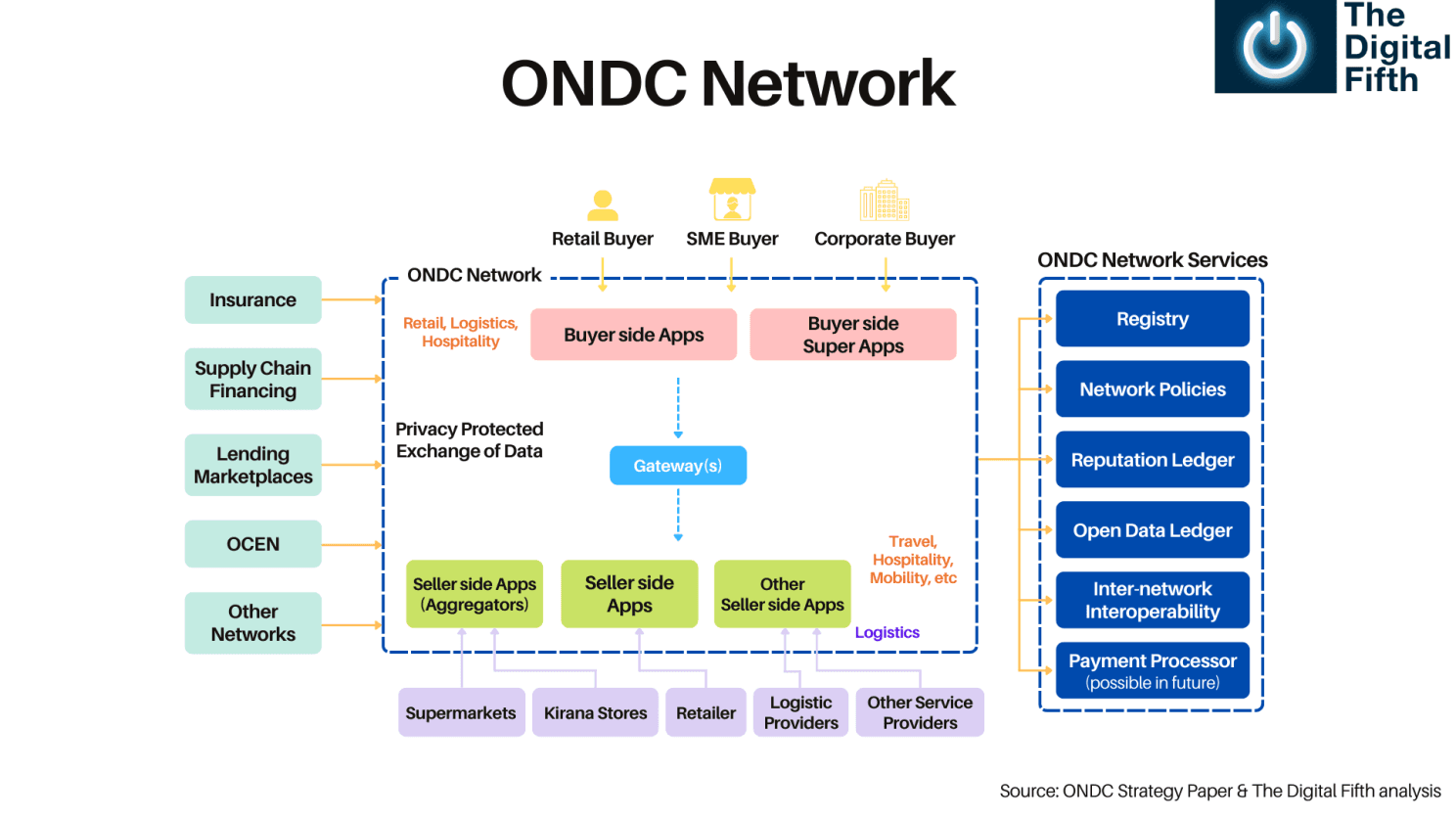

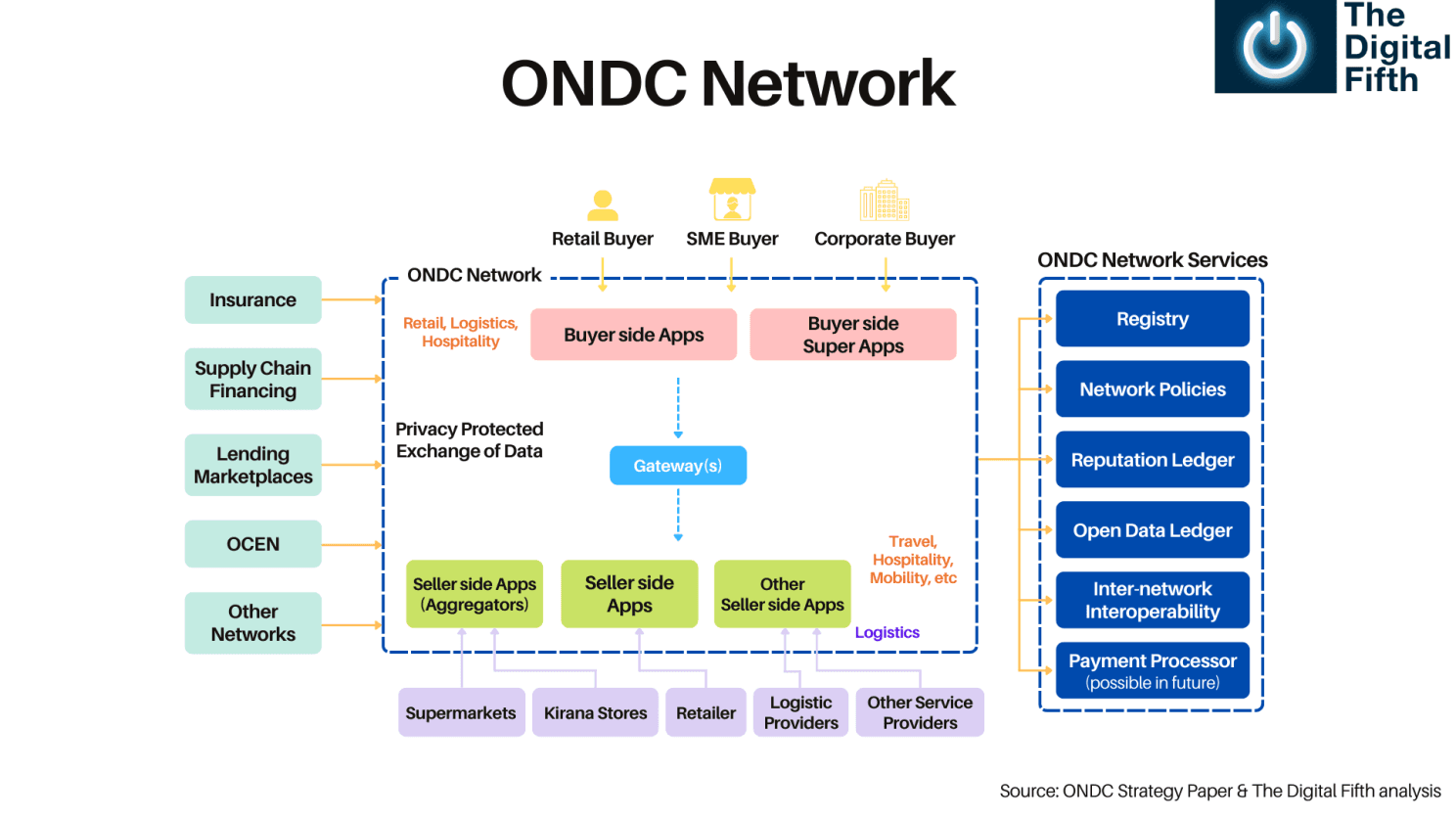

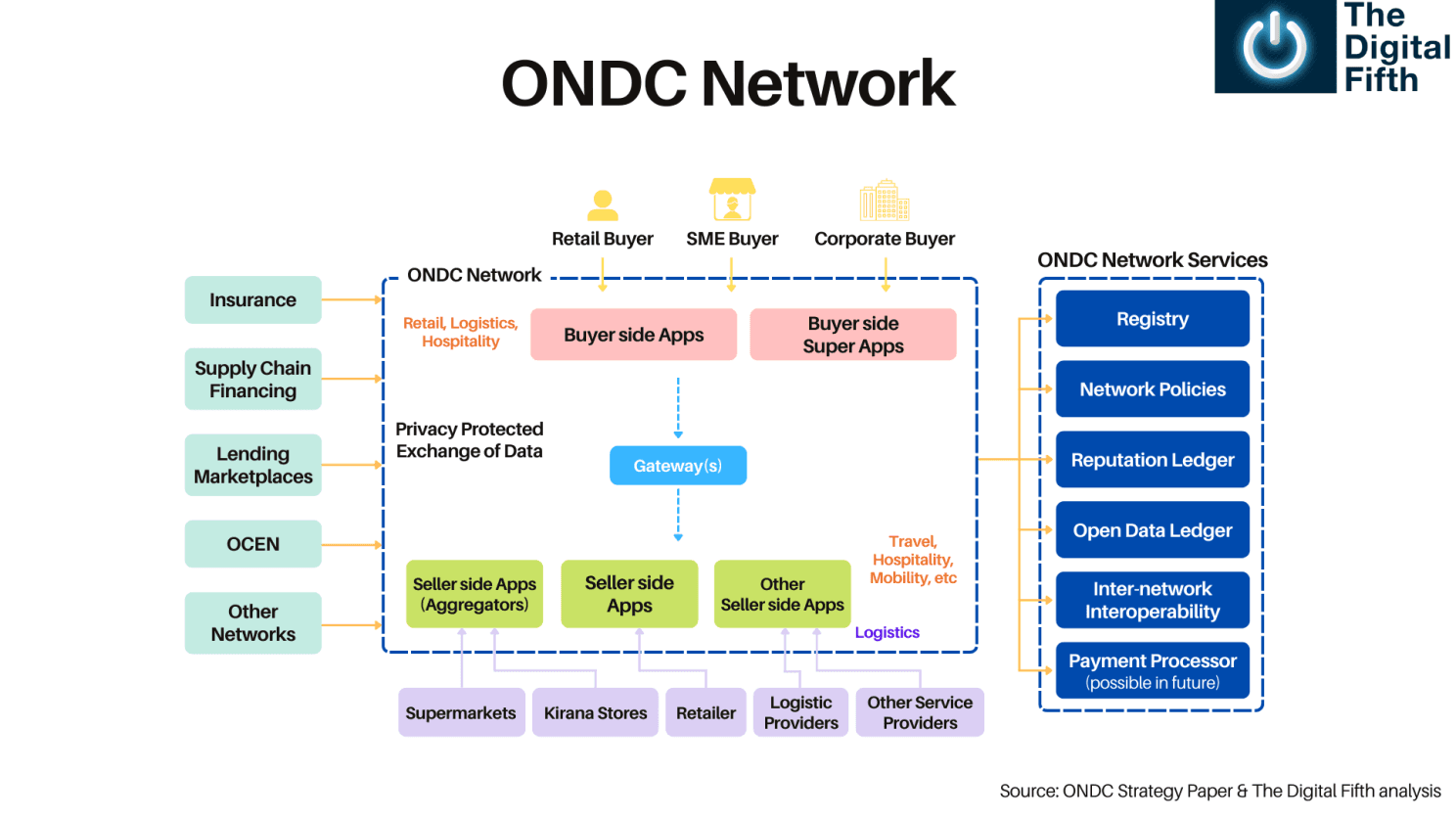

(Credit: The Digital Fifth)

ONDC creates a marketplace where lenders and borrowers connect, providing a wider range of lending options and lower operational costs, ideal for businesses and individuals. OCEN supports platforms by automating the lending process, enabling quick, seamless loans through digital apps. ULI integrates lending directly into everyday online experiences, allowing borrowers to access loans or installment plans instantly at checkout, making borrowing more convenient and flexible.

India's digital lending market is expected to grow from $250 billion in 2023 to $1.3 trillion by 2030, showing how quickly the financial sector is changing. The ONDC ecosystem is an ambitious government initiative, and the addition of such financial services comes at a crucial time when technology is also advancing, the demand for financial services is growing, and people are more open to adopting new technologies.

If you’re a seller interested in joining ONDC, SellerSetu is ready to help! Head to our website to get started.

Fill out the form below to schedule a demo and see how we can streamline your onboarding process while improving your experience. Our platform is built to help you sell online and foster your business growth. Start your journey with ONDC and reap the benefits!

(Credit: The Digital Fifth)

ONDC creates a marketplace where lenders and borrowers connect, providing a wider range of lending options and lower operational costs, ideal for businesses and individuals. OCEN supports platforms by automating the lending process, enabling quick, seamless loans through digital apps. ULI integrates lending directly into everyday online experiences, allowing borrowers to access loans or installment plans instantly at checkout, making borrowing more convenient and flexible.

India's digital lending market is expected to grow from $250 billion in 2023 to $1.3 trillion by 2030, showing how quickly the financial sector is changing. The ONDC ecosystem is an ambitious government initiative, and the addition of such financial services comes at a crucial time when technology is also advancing, the demand for financial services is growing, and people are more open to adopting new technologies.

If you’re a seller interested in joining ONDC, SellerSetu is ready to help! Head to our website to get started.

Fill out the form below to schedule a demo and see how we can streamline your onboarding process while improving your experience. Our platform is built to help you sell online and foster your business growth. Start your journey with ONDC and reap the benefits!

More on ONDC…

More on ONDC…

Are You Ready To Start A Successful Journey On ONDC ?

Join the growing community of successful sellers who trust SellerSetu for their online selling needs. Start selling on the best online marketplace on ONDC. Fill out this form, and our team will reach out to you within the next 24 hours.

Are You Ready To Start A Successful Journey On ONDC ?

Join the growing community of successful sellers who trust SellerSetu for their online selling needs. Start selling on the best online marketplace on ONDC. Fill out this form, and our team will reach out to you within the next 24 hours.

Are You Ready To Start A Successful Journey On ONDC ?

Join the growing community of successful sellers who trust SellerSetu for their online selling needs. Start selling on the best online marketplace on ONDC. Fill out this form, and our team will reach out to you within the next 24 hours.